A Geopolitical Nexus

- Are authentic fully integrated critical minerals strategies mature?

- What do these strategies mean for different countries?

- For different companies?

The Blended Capital Group provides expert advice, support and consulting on the development of strategies that are fit for the purpose of today’s complex geopolitically charged economically critical realities through the combination of governance, strategic and mining expertise in our team.

Wood MacKenzie projections:

- $1.0T of net new investment in critical minerals value chains is needed through to 2035

- Copper alone requires $23B of net new investment by year for the next thirty years

- Critical Minerals investment is needed for both mining and refining

As further context:

- We need to mine as much copper in the next 50 years as we have over the last 5,000

years - Other critical minerals have similar growth curves, given the combination of energy,

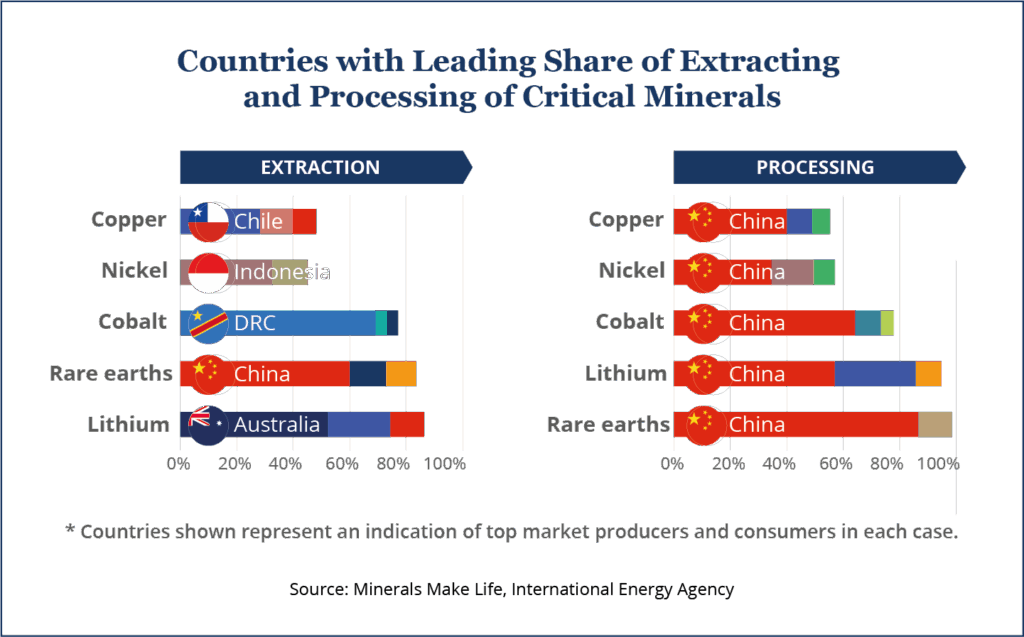

economic and military applications that are rapidly growing - Most critical minerals are concentrated in a handful of countries:

- 70% of global cobalt production is found in the DRC

- 51% of global nickel production is found in Indonesia

- Copper is concentrated in a handful of countries – Chile, Peru, DRC

- China refines about two thirds of the world’s critical minerals, including 90% of rare

earth elements, and also controls the majority of the world’s critical minerals mining

Country Perspective – Public Policy Governance

- Is there clarity on what minerals are critical given economic, energy and military

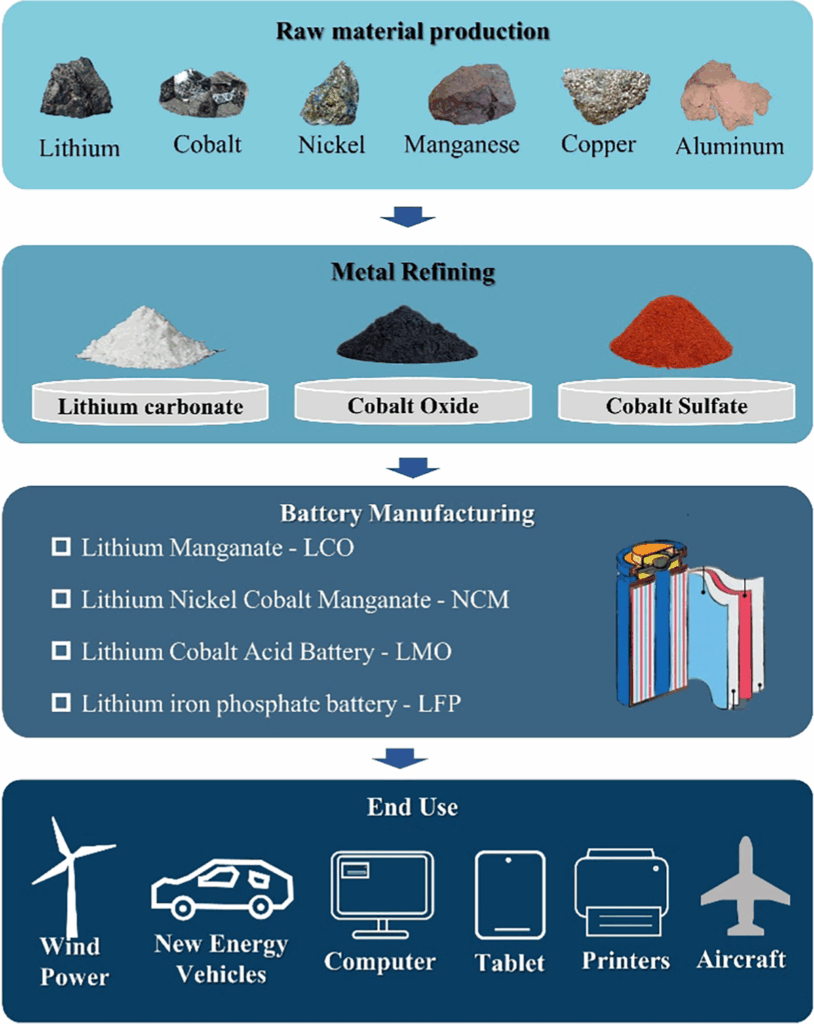

applications of different minerals? Criticality will vary by country - Is there clarity on what mineral value chains look like? Where are minerals mined and

where are they refined? What risks do these value chains bring to a given country? - How can in-country mining, friend-shoring and broader sourcing combine to deliver

mineral security? - How can in-country refining, friend-shoring and broader sourcing combine to deliver

mineral security? - For mining intensive countries, what are the policies and practice that support

converting resource wealth into sustainable development? Are legal frameworks clear and are they integrated with public policies that are growth oriented? Do they consider both large scale and artisanal mining?

Private Sector Perspective – Governing Value / Risks / Supply Predictability

- Are your critical minerals needs clear?

- Are mineral value chains clear, with mining and refining risks well understood from the

perspective of your enterprise? - Are strategies to secure supply clear, whether in-country, from allied countries or from a

broader generic sourcing perspective?

Mining and Refining Value Chain Perspective – Governing Productivity / Risks / Value

- Is your enterprise positioned to deliver growth and value given the supply and

geopolitical dynamics that are in play across various critical minerals? - Is your enterprise positioned to engage across diverse countries in delivering predictable

secure supply in ways that benefit from earned social license? - Is your enterprise positioned to engage across various statutory jurisdictions and to

target value in the context of critical minerals geopolitical challenges?

Critical Minerals are the new oil – it is impossible to overstate the strategic imperative of economic, energy and military security. Each of the above questions are relevant for developing and delivering strategies that make sense.

Reach out, and The Blended Capital Group will connect you with the relevant governance, strategic and mining expertise in order to support the development of strategies that make sense given today’s complex geopolitical and economic realities.